El impacto de las fluctuaciones del precio del mercado del oro en los costos de los módulos ópticos

A continuación se presenta un análisis de los cambios en el mercado del oro en 2025:

I. Tendencia de precios: operando en niveles históricamente altos

1.

Precio internacional del oro

:A partir de noviembre de 2025, el precio internacional del oro superó los 4.200 dólares por onza, con un aumento de casi el 50% este año, y continuó marcando nuevos máximos históricos.

2.

Precios del oro interno

:El precio de las joyas de oro puro de marca ha superado los 1.200 yuanes/gramo en todos los ámbitos, un aumento de alrededor del 50% desde principios de año, y la diferencia de precio entre el oro y el oro en bruto se ha ampliado aún más.

3. Factores impulsores :

(1). La caída de la confianza en el dólar estadounidense :El aumento de la deuda nacional de Estados Unidos y la erosión de la base crediticia del dólar resaltan el valor del oro como "moneda fuerte de refugio seguro".

(2). La oleada de compras de oro de los bancos centrales Los bancos centrales mundiales continúan aumentando estratégicamente sus reservas de oro, reduciendo la liquidez del oro físico en el mercado y aumentando la sensibilidad de los precios del oro.

(3). Riesgos geopolíticos Los conflictos regionales y las incertidumbres exacerban la aversión al riesgo del mercado, lo que convierte al oro en una herramienta importante para cubrir riesgos sistémicos.

(4). Rigidez de la inflación Un entorno inflacionario persistente fortalece las propiedades antiinflacionarias del oro, atrayendo a los inversores a asignar sus activos al sector.

II. Lado del consumidor: Diferenciación estructural significativa

1.

El consumo de joyas está estancado:

Datos: En los primeros tres trimestres de 2025, el consumo de joyas de oro de China fue de 270.036 toneladas, una disminución interanual del 32,50%; el valor del consumo de joyas de oro aumentó un 13% interanual, alcanzando los 41 mil millones de dólares (impulsado por el aumento de los precios del oro).

Razón: Los altos precios del oro han suprimido la demanda de joyas tradicionales de oro pesado, lo que ha llevado a los consumidores a optar por productos livianos y de alto valor agregado.

2.

Crecimiento explosivo de la demanda de inversión:

Lingotes y monedas de oro: El consumo en los tres primeros trimestres alcanzó las 352.116 toneladas, un incremento interanual del 24,55%, superando por primera vez la demanda de inversión a la decorativa (representando el 52,3%).

ETF de oro: el tamaño del ETF de oro nacional ha aumentado a 170.800 millones de yuanes, un aumento interanual del 211%, convirtiéndose en un canal importante para que los inversores comunes ingresen al mercado.

3.

El auge de los consumidores jóvenes:

El principal grupo de consumidores: la tasa de propiedad de joyas de oro entre los consumidores de 18 a 24 años se ha disparado del 37% hace cinco años al 62%, y la generación más joven impulsa su comportamiento de compra de oro mediante una combinación de "consumo autocomplaciente" y "ahorros estables".

III. Lado de la oferta: Desarrollo de recursos e innovación tecnológica

1.

Suministro de oro desde las minas:

En 2024, la producción mundial de oro fue de 3.661,2 toneladas, lo que representa el 74% del suministro total; a fines de 2023, los recursos mundiales de oro probados eran de aproximadamente 132.000 toneladas, que podrían extraerse durante otros 30 años.

Los proyectos clave de China están progresando: la evaluación preliminar de la mina de oro de Dadonggou en la provincia de Liaoning indica un volumen de recursos de casi 1.500 toneladas, lo que se espera que la convierta en una mina de oro de clase mundial; el pozo auxiliar de la mina de oro de Sanshandao ha alcanzado una profundidad de 2.005 metros, lo que rompe la tecnología para la construcción de minas ultraprofundas.

2.

Demanda de oro industrial:

Los avances tecnológicos en campos como la electrónica, las nuevas energías, los chips de IA y las pilas de combustible de hidrógeno han impulsado una recuperación constante del consumo industrial de oro, pero su participación total sigue siendo relativamente pequeña (aproximadamente el 7%).

IV. Compras de oro del Banco Central:

Reservas estratégicas y desdolarización

1.

Tendencias de compra de oro por parte de los bancos centrales mundiales:

En los primeros tres trimestres de 2025, las compras netas de oro de los bancos centrales mundiales totalizaron 634 toneladas, lo que es inferior al nivel inusualmente alto de los últimos tres años (1.045 toneladas en 2024), pero todavía significativamente superior al nivel promedio antes de 2022 (alrededor de 400-500 toneladas/año).

El Banco Popular de China ha aumentado sus reservas de oro por 12 meses consecutivos, aumentando las reservas en 30.000 onzas hasta 74,09 millones de onzas a finales de octubre, con el fin de optimizar la estructura de las reservas de divisas y diversificar los riesgos de los activos en dólares.

2.

Motivación para comprar oro:

Riesgos geopolíticos: La creciente incertidumbre en el entorno internacional y el papel del oro como "medio de pago definitivo" mejoran la credibilidad de las monedas soberanas.

Internacionalización del RMB: el aumento de las tenencias de oro crea condiciones favorables para el avance constante y prudente de la internacionalización del RMB.

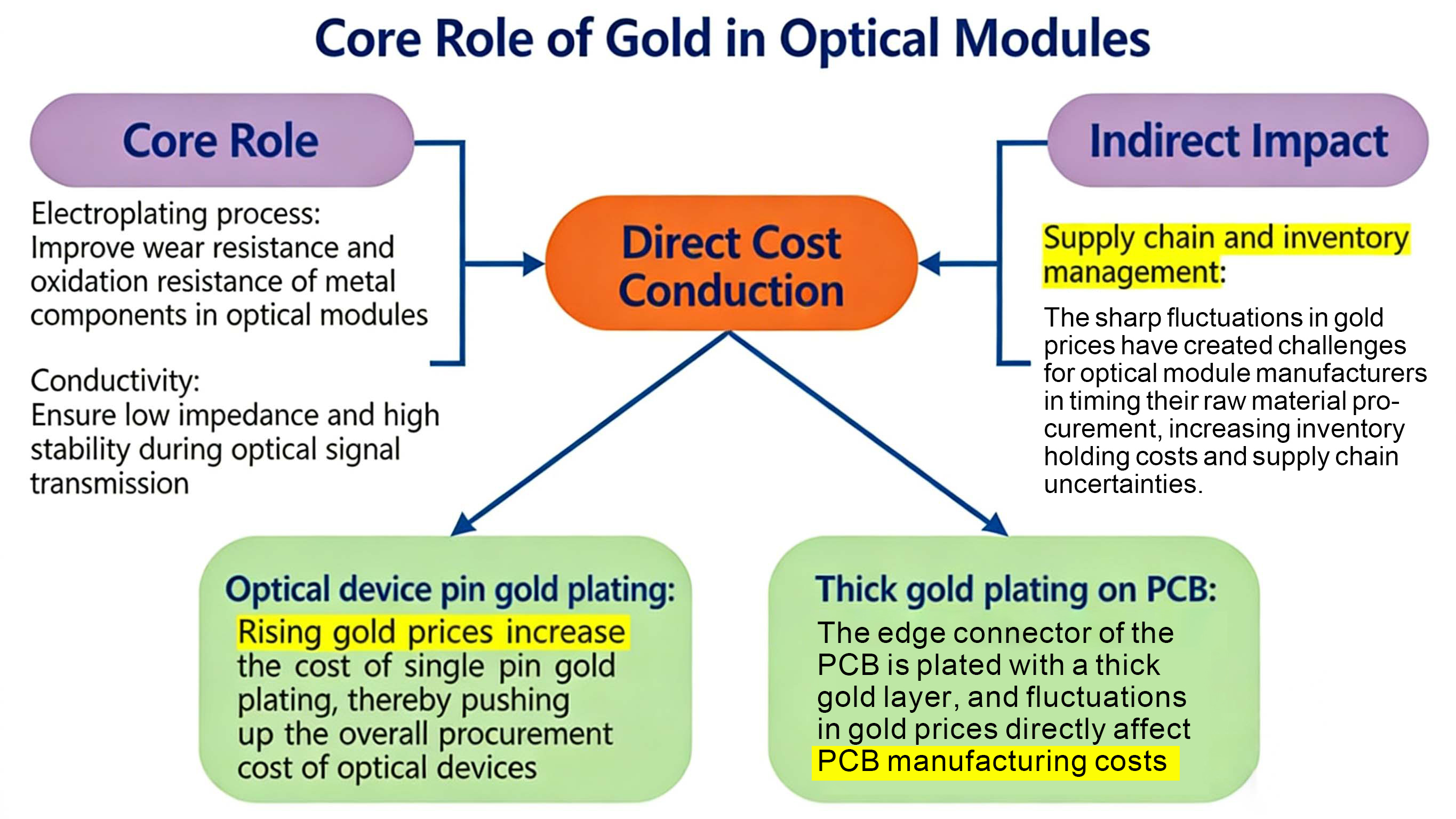

V. Las fluctuaciones en el precio del oro tienen un impacto significativo en el costo de los módulos ópticos. A continuación, se presenta un análisis detallado:

A. El papel central y el porcentaje de coste del oro en los módulos ópticos

Debido a su excelente conductividad, resistencia a la corrosión y estabilidad, el oro se utiliza principalmente en procesos de galvanoplastia en módulos ópticos (como conectores e interfaces) para garantizar la confiabilidad y durabilidad de la transmisión de señales.

Aunque la cantidad de oro utilizada en un solo módulo óptico es relativamente pequeña, el costo del oro aún puede ser una variable importante cuando se lleva a cabo la producción en masa.

Por ejemplo,

la galvanoplastia de oro duro u oro químico

en

los dedos de oro

de una PCB

debe alcanzar un cierto espesor para cumplir con los requisitos de

resistencia al desgaste y

bien

transmisión de señales

B. El impacto específico de las fluctuaciones del precio del oro en los costos

1.

Transmisión directa de costos

El aumento del precio del oro incrementará directamente el coste de las materias primas en el proceso de galvanoplastia. Se prevé que en 2025 el precio del oro aumente más del 50 % en comparación con principios de año, lo que ejercerá una presión significativa sobre los costes.

Las presiones de costos provienen principalmente de dos partes:

* Pines de componentes ópticos chapados en oro.

* PCB chapado en oro grueso

2.

Impacto indirecto: cadena de suministro y gestión de inventarios

Las fluctuaciones en el precio del oro pueden desencadenar una reacción en cadena a lo largo de la cadena de suministro. Por ejemplo, los proveedores pueden subir los precios debido al aumento de los costos, o las empresas pueden verse obligadas a ajustar sus estrategias de inventario (como reducir el inventario para mitigar el riesgo de caídas de precios), lo que repercute aún más en las estructuras de costos.

Si elige un proveedor de módulos ópticos y no han aumentado los precios, aproveche esa oportunidad, porque se enfrentan a la doble presión del aumento de los costos y la caída de los precios.

ETU-Link Technology Co., Ltd.

Siempre se ha adherido a proporcionar productos y artesanía de alta calidad para crear una perspectiva prometedora de desarrollo del mercado futuro.

Anterior :

¿Qué es un motor óptico?próximo :

Impacto del Al en el mercado de módulos ópticosCategorías

nuevo blog

Etiquetas

© Derechos de autor: 2026 ETU-Link Technology CO ., LTD Reservados todos los derechos.

Soporta red IPv6